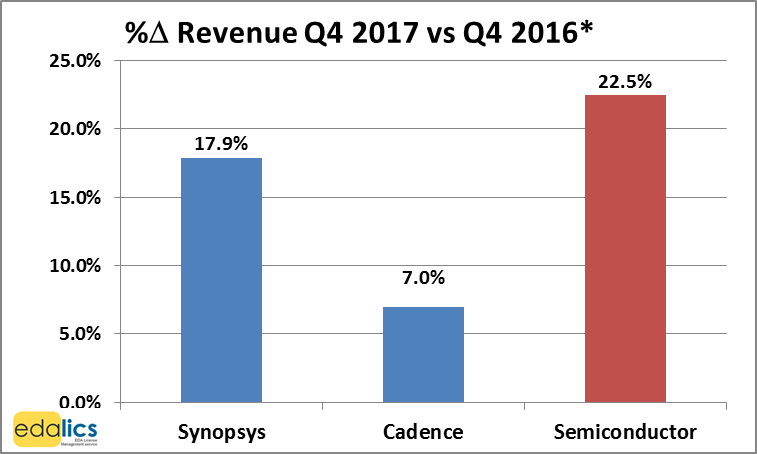

Global semiconductor revenue hit another record high of $114.0 billion in Q4 2017, demonstrating strong and consistent growth of 22.5% vs. Q4 2016 (SIA), following 22.2% growth in Q3 2017 and 23.7% growth in Q2 2017, with 21.6% 2017 full year growth to $412 Billion. Gartner is forecasting further healthy growth in semiconductor revenue for 2018 to $451 billion.

As regards the two major EDA suppliers, Synopsys is emulating the strong semiconductor growth, growing revenues by 17.9% Q4* 2017 vs Q4* 2016, while Cadence continues to grow revenues more slowly, reporting 7.0% growth:

For comparison, the % growth rates in the previous quarter, Q3* 2017 versus Q3* 2016 were Synopsys 9.9%, Cadence 8.8%, ESD Alliance 8.0% and semiconductor 22.2%.

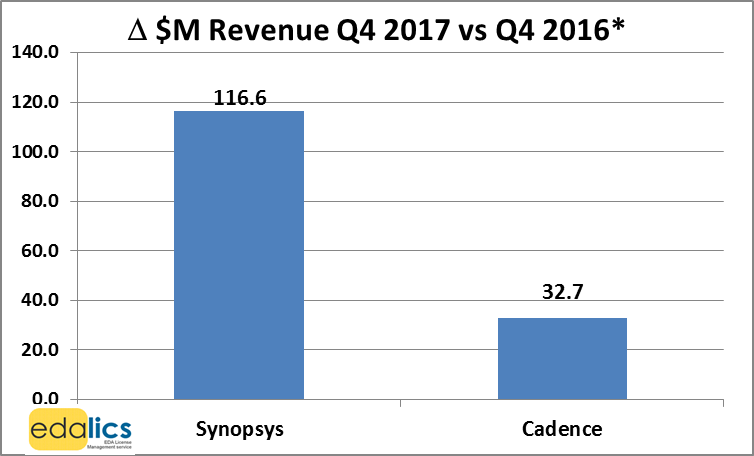

Examining the delta in revenue growth in dollars, Synopsys and Cadence’s Q4* 2017 vs Q4* 2016 revenues increased by $116.6M and $32.7M respectively. Synopsys and Cadence both surpassed their previous mid-point revenue guidance for the quarter, Synopsys by $17M and Cadence by $6.7M:

Guidance for the next quarter

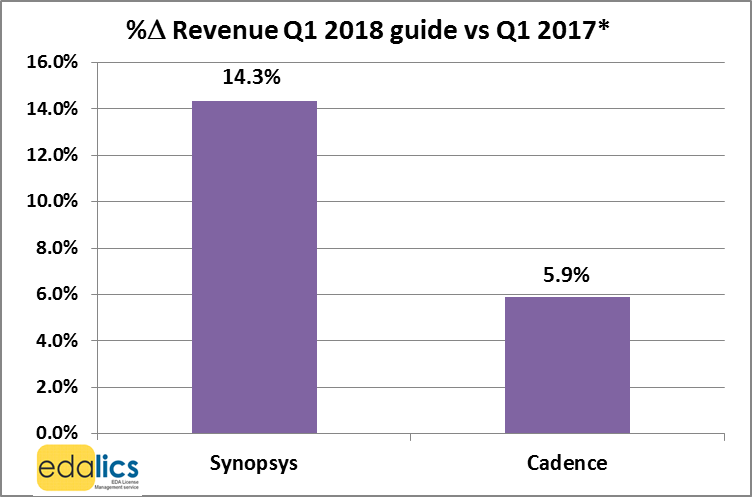

The EDA companies’ own guidance (mid-point) for Q1* 2018 equates to percentage revenue growth as follows: Synopsys: 14.3% ($97.4M growth to $777.5M); Cadence 5.9% growth ($28.1M growth to $505M), as Synopsys continues to forecast growth at more than double the percentage growth rate of Cadence:

In summary, Q4 2017 global semiconductor revenue grew by 22.5% to a yet another record high of $114 Billion, while Synopsys revenues grew by 17.9% and Cadence by 7.0%. The EDA companies own guidance for Q4* 2017 is for Synopsys to grow revenues by 14.3% and Cadence by 5.9%.

The author, Gerry Byrne is the founder of edalics, the only independent EDA Budget Management advisor to leading semiconductor companies.

To subscribe to future quarterly EDA results updates, simply email: subscribe@edalics.com .

* Based on each company’s reported financial quarterly data which most closely match that calendar quarter.