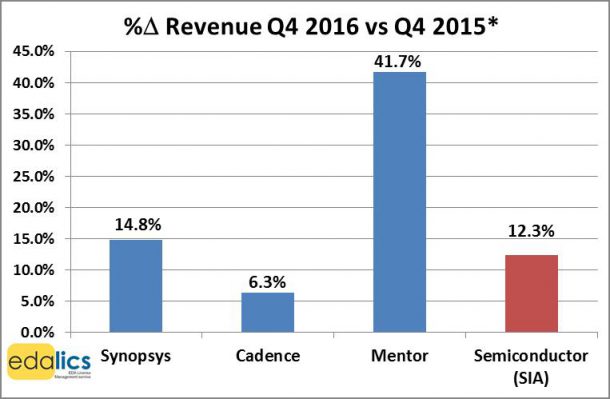

During Q4 2016 global semiconductor revenue growth accelerated to 12.3% vs. Q4 2015 (SIA), to achieve record 2016 annual semiconductor revenues of $338.9 billion, 1.1% higher than in 2015. With this positive semiconductor industry background, Synopsys returned to strong 14.8% Q4* growth vs Q4* 2015, only to be significantly eclipsed by Mentor’s 41.7% growth rate, while Cadence reported steady 6.3% growth:

During Q4 2016 global semiconductor revenue growth accelerated to 12.3% vs. Q4 2015 (SIA), to achieve record 2016 annual semiconductor revenues of $338.9 billion, 1.1% higher than in 2015. With this positive semiconductor industry background, Synopsys returned to strong 14.8% Q4* growth vs Q4* 2015, only to be significantly eclipsed by Mentor’s 41.7% growth rate, while Cadence reported steady 6.3% growth:

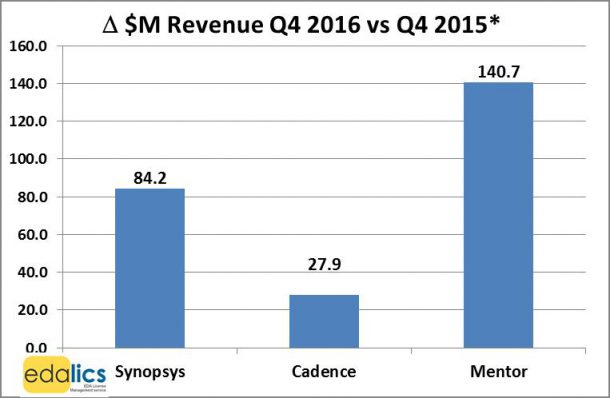

Examining the delta in revenue growth in dollars, Synopsys and Cadence’s Q4* 2016 vs Q4* 2015 revenues increased by $84.2M and $27.9M respectively, while Mentor’s revenues increased impressively by $140.7M. Synopsys and Cadence surpassed their own mid-point revenue guidance for the quarter by $14.3M and $1.0M respectively.

Q4* 2016 guidance:

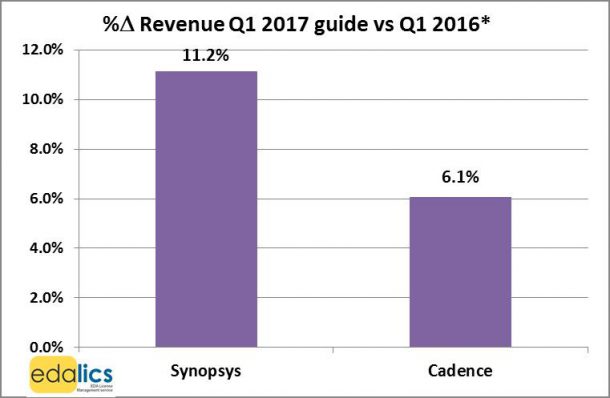

In the following charts, the EDA companies’ own guidance (mid-point) equates to percentage revenue growth for Q1* 2017 as follows: Synopsys: 11.2% (or $67.5M); Cadence 6.1% growth (or $27.1M); while Mentor did not provide guidance as Siemens prepares to acquire it:

In summary, Q4* 2016 saw strong semiconductor revenue growth and a diversity of growth rates from the 3 major EDA suppliers. In addition, the EDA companies own guidance for Q1* 2017 is for Synopsys to continue to grow revenues almost twice as fast as Cadence.

These charts are an extract from edalics’ quarterly EDA Market Executive Briefing, which provides a deeper analysis of product segment revenues, exploring the reasons behind and implications of quarterly revenue trends. It provides a comprehensive, but concise quarterly summary of EDA market news and statistics for all managers with EDA budget responsibility, whether in Engineering, Purchasing or Finance departments. For more details see: EDA Market Executive Briefing

To request a free sample EDA Market Executive Briefing report, simply email: EDAExecBrief@edalics.com

To schedule a meeting with edalics at the upcoming DAC conference in Austin, June 18-22, simply email: Query@edalics.com

*Based on each company’s reported financial quarterly data which most closely match that calendar quarter.