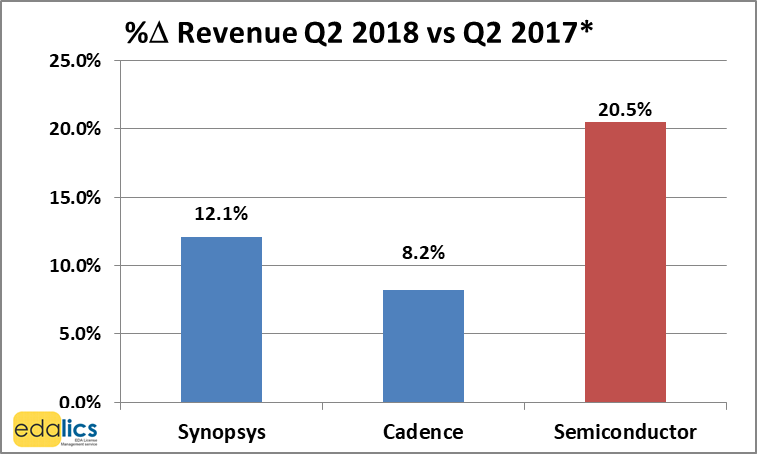

Global semiconductor revenue continued its robust growth of 20.5% to $117.9 billion in Q2 2018 vs. Q2 2017 (SIA), following 20% growth in Q1 2018. Gartner is forecasting 14% full year growth in semiconductor revenue to $479 billion for 2018.

Meanwhile, revenues in the EDA market grew steadily, with the no. 1 EDA tool supplier, Synopsys growing quarterly revenues by 12.1% Q2* 2018 vs Q2* 2017 to $779.7M, while the no. 2 supplier, Cadence reported 8.2% growth to $518.4M:

For comparison, the % growth rates in the previous quarter, Q1* 2018 versus Q1* 2017 were Synopsys 14.2%, Cadence 8.5%, ESD Alliance 7.8% and semiconductor 20%.

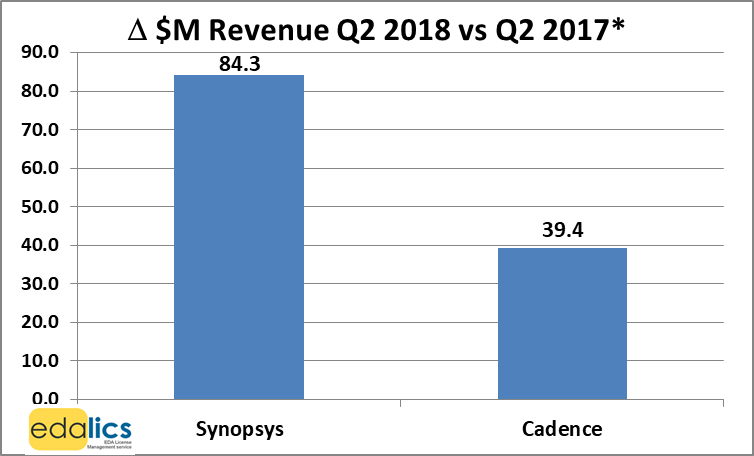

Examining the delta in revenue growth in dollars, Synopsys and Cadence’s Q2* 2018 vs Q2* 2017 revenues increased by $84.3M and $39.4M respectively, surpassing their prior mid-point guidance by $7.2M and $3.4M respectively:

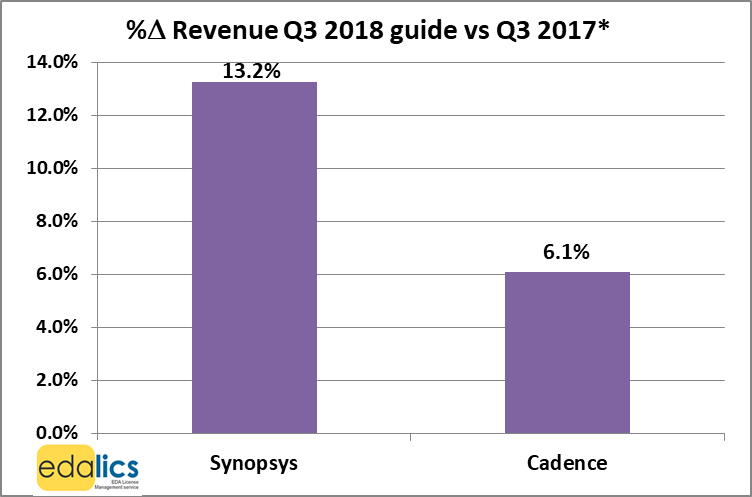

Guidance for the next quarter

The EDA companies’ own guidance (mid-point) for Q3* 2018 equates to percentage revenue growth as follows: Synopsys: 13.2% ($92.3M growth to $789.0M); Cadence 6.1% growth ($29.6M growth to $515M – according to ASC 606 reporting rules):

In summary, Q2 2018 global semiconductor revenue continued robust growth of 20.5% to $117.9 Billion, while Synopsys revenues grew by 12.1% and Cadence by 8.2%. The EDA companies own guidance for Q3* 2018 is for Synopsys to grow revenues by 13.2% and Cadence by 6.1%.

To subscribe to future quarterly EDA results updates, simply email: subscribe@edalics.com. The author, Gerry Byrne, is the founder of edalics, the only consultancy which benchmarks and reduces EDA budget costs for leading semiconductor companies.

* Based on each company’s reported financial quarterly data which most closely match that calendar quarter