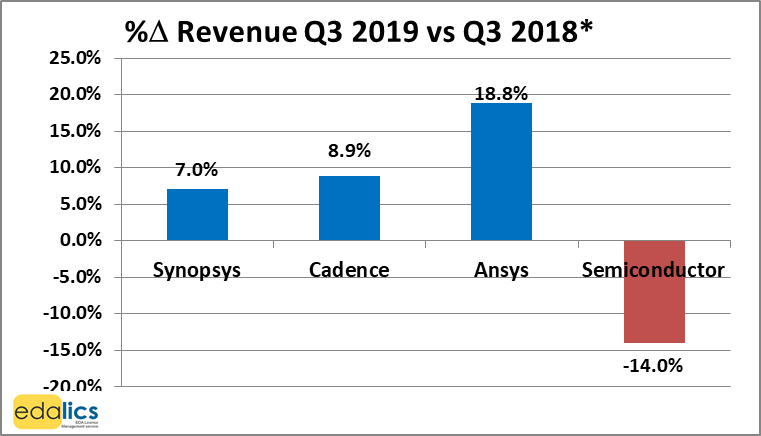

EDA revenue growth vs. Semiconductor revenue decline continues in Q3

Global semiconductor revenues dropped by 14.0% to $107.4 billion in Q3 2019 vs. Q3 2018 (WSTS), following a 16.4% decline in Q2 2019 vs. Q2 2018.

However, despite the continued decline in semiconductor revenues, revenues in the EDA market continued to grow steadily, with Synopsys growing quarterly revenues by 7.0% Q3* 2019 vs Q3* 2018 to $851M, while Cadence reported 8.9% growth to $579.6M and Ansys grew its quarterly revenues fastest by 18.8% Q3* 2019 vs Q3* 2018 to $343.9M:

These results for Q3 are all lower growth rates than in the previous quarter Q2 when Synopsys grew quarterly revenues by 9.4% (Q2* 2019 vs Q2* 2018) to $853M, while Cadence reported double digit 12% growth to $580.4M and Ansys grew its quarterly revenues fastest by 20.5% to $368M.

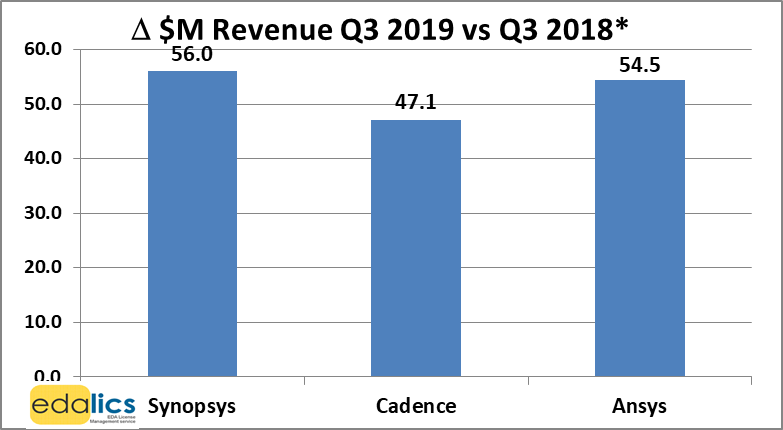

Examining the delta in revenue growth in dollars, Synopsys, Cadence and Ansys’ Q3* 2019 vs Q3* 2018 revenues increased by $56.0, $47.1 and $54.5 Million respectively, surpassing their prior mid-point guidance by $6.0M, $4.6M and $15.5M respectively:

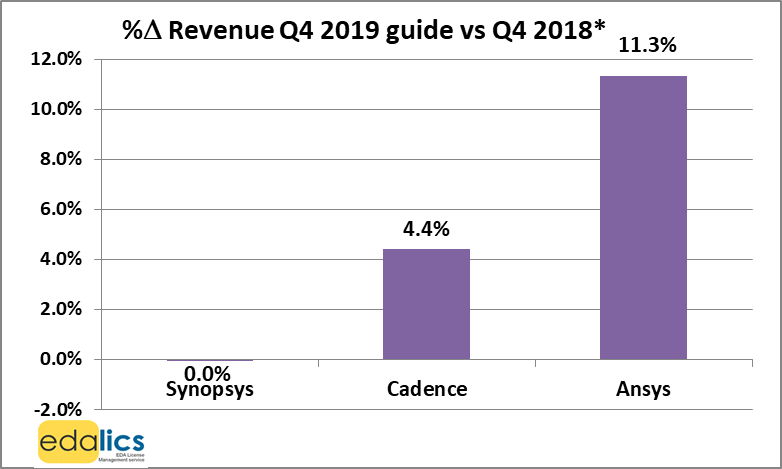

Guidance for the next quarter

The EDA companies’ own mid-point guidance is as follows in Q4* 2019:

• Synopsys: 0.0% ($0.4M decline to $820M under ASC 606 rules)

• Cadence 4.4% growth ($25.2 growth to $595M under ASC 606 rules)

• Ansys 11.3% growth ($47.0M growth to $462.4M under ASC 606 rules)

Their own full fiscal year 2019 growth forecasts are: Synopsys 7.9%, Cadence 9.1%, Ansys 15.3%.

In summary, global semiconductor revenue dropped by 14% to $107.4 billion in Q3 2019 vs. Q3 2018 (SIA), while Synopsys revenues grew by 7.0%, Cadence by 8.9% and Ansys by 18.8%. The EDA companies’ own guidance for Q4 2019 is for slower growth rates: Synopsys revenues to flat line, Cadence to grow by 4.4% and Ansys to grow by 11.3%.

The author, Gerry Byrne, is the founder of edalics, the niche consultancy which benchmarks and reduces EDA budget costs for leading semiconductor companies.

* Based on each company’s reported financial quarterly data which most closely match that calendar quarter.